Market Outlook

August 30, 2017

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open flat tracking global indices and SGX Nifty.

BSE Sensex

(1.1)

(362)

31,388

U.S. equity markets regained their footing to close higher on Tuesday as investors

Nifty

(1.2)

(117)

9,796

shook off the tension between the U.S. and North Korea. The Dow Jones industrial

Mid Cap

(0.8)

(130)

15,278

average erased earlier losses to end 56.9 points higher at 21,865, with United

Small Cap

(1.0)

(162)

15,656

Technologies and Boeing contributing the most to the gains. The index fell as much

Bankex

(1.1)

(291)

27,261

as 134.8 points earlier in the session.

The European markets ended Tuesday's session firmly in negative territory after

Global Indices

Chg (%)

(Pts)

(Close)

North Korea launched a ballistic missile over Japan. Japanese Prime Minister Shinzo

Abe described the missile launch as "an unprecedented, serious and grave threat" to

Dow Jones

0.3

57

21,865

Asia's second-largest economy, adding that he and U.S. President Donald Trump

Nasdaq

0.3

19

6,302

are in complete agreement to hike pressure on North Korea.

FTSE

(0.9)

(64)

7,337

Indian shares fell sharply on Tuesday, tracking weakness in Asia and Europe, after

Nikkei

0.6

111

19,474

North Korea launched a ballistic missile over Japan, reigniting geopolitical worries.

Hang Seng

0.6

168

27,933

Shanghai Com

0.1

4

3,369

News Analysis

HCL Infosystems to raise `500cr via rights issue

Advances / Declines

BSE

NSE

Advances

801

479

Detailed analysis is on Pg2

Declines

1,790

1,215

Investor’s Ready Reckoner

Unchanged

128

54

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Volumes (` Cr)

Refer Pg7 onwards

BSE

3,696

NSE

23,705

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

#Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Accumulate

752

760

1.1

FII

96 (11,869)

46,528

Dewan Housing FinanceFinancials

Accumulate

493

520

5.5

Mahindra Lifespace

Real Estate

Buy

435

522

20.0

MFs

1,566 14,506

65,452

Navkar Corporation

Others

Buy

190

265

39.5

KEI Industries

Capital Goods

Accumulate

245

258

5.2

Top Gainers

Price (`)

Chg (%)

More Top Picks on Pg5

Bajajhldng

126

4.4

Key Upcoming Events

Rblbank

21

4.1

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

Ghcl

8

3.3

Aug 30, 2017 Euro Zone Euro-Zone Consumer Confidence

(1.50)

(1.50)

Relinfra

14

3.0

Aug 30, 2017 US

Initial Jobless claims

234.00

236.50

Kec

9

2.9

Aug 31, 2017 US

GDP Qoq (Annualised)

2.60

2.70

Aug 31, 2017 Germany Unemployment change (000's)

(8.00)

(6.00)

Top Losers

Price (`)

Chg (%)

More Events on Pg7

Jpassociat

(2)

(9.6)

Indiacem

(9)

(5.1)

Fsl

(2)

(4.9)

Jetairways

(27)

(4.8)

J&Kbank

(4)

(4.7)

#as on 29th Aug, 2017

Market Outlook

August 30, 2017

News Analysis

HCL Infosystems to raise `500cr via rights issue

The information technology (IT) services and distribution services arm of the HCL

Enterprise- HCL Infosystems- said the company's board has approved a plan to

raise up to ` 500cr from its existing shareholders.

HCL Infosystems' Board had, in an August 29 meeting, considered and approved

the recommendations of its capital raising committee to go for a rights issue of

shares to existing shareholders of the company as a mode of raising equity capital

aggregating up to `500cr.

As on June-end in 2017, promoters and promoters' group held 58% shares at HCL

Info. The company, which reported a net loss of `55.1cr on a revenue of `684.2cr

in Q1, recently announced that it would distribute Apple products, including

iPhone, in the Indian market. To meet this purpose, HCL Info had, in December

2016, signed a non-disclosure agreement with Apple India.

HCL Infosystems is looking to expand its footprint in India after working with some

of the leading brands of the country, including Lenovo, Motorola and Nokia,

among others

Economic and Political News

7th Pay Commission: `4,500cr burden on Odisha govt

Jute industry fears `200cr loss on new pricing formula

Odisha seafood park gets `466cr investment proposals

GST: `92,283cr collected in July, compliance at 64.42%, says Jaitley

Corporate News

TVS Logistics eyes $1-billion revenue in 3 years

IOC to invest `32,000cr to ramp up petrochemicals capacity by FY21

HCL Infosystems to raise `500cr via rights issue

MRF Tyres plans to invest around `1000cr a year till 2020-21

Market Outlook

August 30, 2017

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its leadership

in acute therapeutic segment. Alkem expects to launch

Alkem Laboratories

20,947

1,752

2,161

23.3

more products in USA, which bodes for its international

business.

We expect the company would report strong profitability

11.1

Asian Granito

1,300

432

480

owing to better product mix, higher B2C sales and

amalgamation synergy.

Favorable outlook for the AC industry to augur well for

1.1

Cooling products business which is out pacing the

Blue Star

7,198

752

760

market growth. EMPPAC division's profitability to improve

once operating environment turns around.

With a focus on the low and medium income (LMI)

5.5

consumer segment, the company has increased its

Dewan Housing Finance

15,453

493

520

presence in tier-II & III cities where the growth

opportunity is immense.

Loan growth is likely to pick up after a sluggish FY17.

Karur Vysya Bank

7,355

139

160

15.1

Lower credit cost will help in strong bottom-line growth.

Increasing share of CASA will help in NIM improvement.

High order book execution in EPC segment, rising B2C

KEI Industries

1,909

245

258

5.2

sales and higher exports to boost the revenues and

profitability

Speedier execution and speedier sales, strong revenue

Mahindra Lifespace

2,234

435

522

20.0

visibility in short-to-long run, attractive valuations

Expected to benefit from the lower capex requirement

Music Broadcast

2,123

373

434

16.4

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage at

Navkar Corporation

2,698

190

265

39.5

ICD as well CFS augurs well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

1,943

2,080

2,500

20.2

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no.

2

41.0

viewership ranking in English news genre, exit from the

TV Today Network

1,437

244

344

radio business, and anticipated growth in ad spends by

corporates to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The Gujarat

Maruti Suzuki

2,27,341

7,526

8,544

13.5

plant will also enable higher operating leverage which

will be margin accretive.

Source: Company, Angel Research

Market Outlook

August 30, 2017

Key Upcoming Events

Global economic events release calendar

Bloomberg Data

Date

Time

Country

Event Description

Unit

Period

Last Reported

Estimated

Aug 30, 2017

2:30 PMEuro Zone

Euro-Zone Consumer Confidence

Value

Aug F

(1.50)

(1.50)

6:00 PMUS

Initial Jobless claims

Thousands

Aug 26

234.00

236.50

Aug 31, 2017

6:00 PMUS

GDP Qoq (Annualised)

% Change

2Q S

2.60

2.70

1:25 PMGermany

Unemployment change (000's)

Thousands

Aug

(8.00)

(6.00)

6:00 PMUS

Change in Nonfarm payrolls

Thousands

Aug

209.00

180.00

Sep 01, 2017

6:30 AMChina

PMI Manufacturing

Value

Aug

51.40

51.30

1:25 PMGermany

PMI Manufacturing

Value

Aug F

59.40

59.40

6:00 PMUS

Unnemployment rate

%

Aug

4.30

4.30

2:00 PMUK

PMI Manufacturing

Value

Aug

55.10

55.00

Sep 05, 2017

1:25 PMGermany

PMI Services

Value

Aug F

53.40

2:30 PMEuro Zone

Euro-Zone GDP s.a. (QoQ)

% Change

2Q F

0.60

Sep 07, 2017

5:15 PMEuro Zone

ECB announces interest rates

%

Sep 7

-

Sep 08, 2017

India

Imports YoY%

% Change

Aug

15.40

India

Exports YoY%

% Change

Aug

3.94

2:00 PMUK

Industrial Production (YoY)

% Change

Jul

0.30

China

Exports YoY%

% Change

Aug

7.20

Sep 09, 2017

2:00 PMUK

CPI (YoY)

% Change

Aug

2.60

Sep 12, 2017

7:00 AMChina

Consumer Price Index (YoY)

% Change

Aug

1.40

5:30 PMIndia

Industrial Production YoY

% Change

Jul

(0.10)

Sep 13, 2017

2:00 PMUK

Jobless claims change

% Change

Aug

(4.20)

US

Producer Price Index (mom)

% Change

Aug

(0.20)

Sep 14, 2017

7:30 AMChina

Industrial Production (YoY)

% Change

Aug

6.40

Source: Bloomberg, Angel Research

Market Outlook

August 30, 2017

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

5.7

5.7

10.0

6.0

9.1

8.8

4.9

4.9

9.0

5.0

7.9

8.0

7.9

7.6

7.5

3.8

8.0

7.3

7.2

4.0

7.0

3.0

2.8

2.8

7.0

2.6

6.1

6.1

3.0

1.9

6.0

2.0

5.0

1.0

4.0

-

3.0

(0.1)

(1.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

54.0

6.0

5.1

52.0

5.0

4.3

4.2

3.9

50.0

3.6

3.7

4.0

3.4

3.2

3.0

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

20.0

5.00

10.0

4.50

0 .0

4.00

(10.0)

3.50

(20.0)

(30.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

August 30, 2017

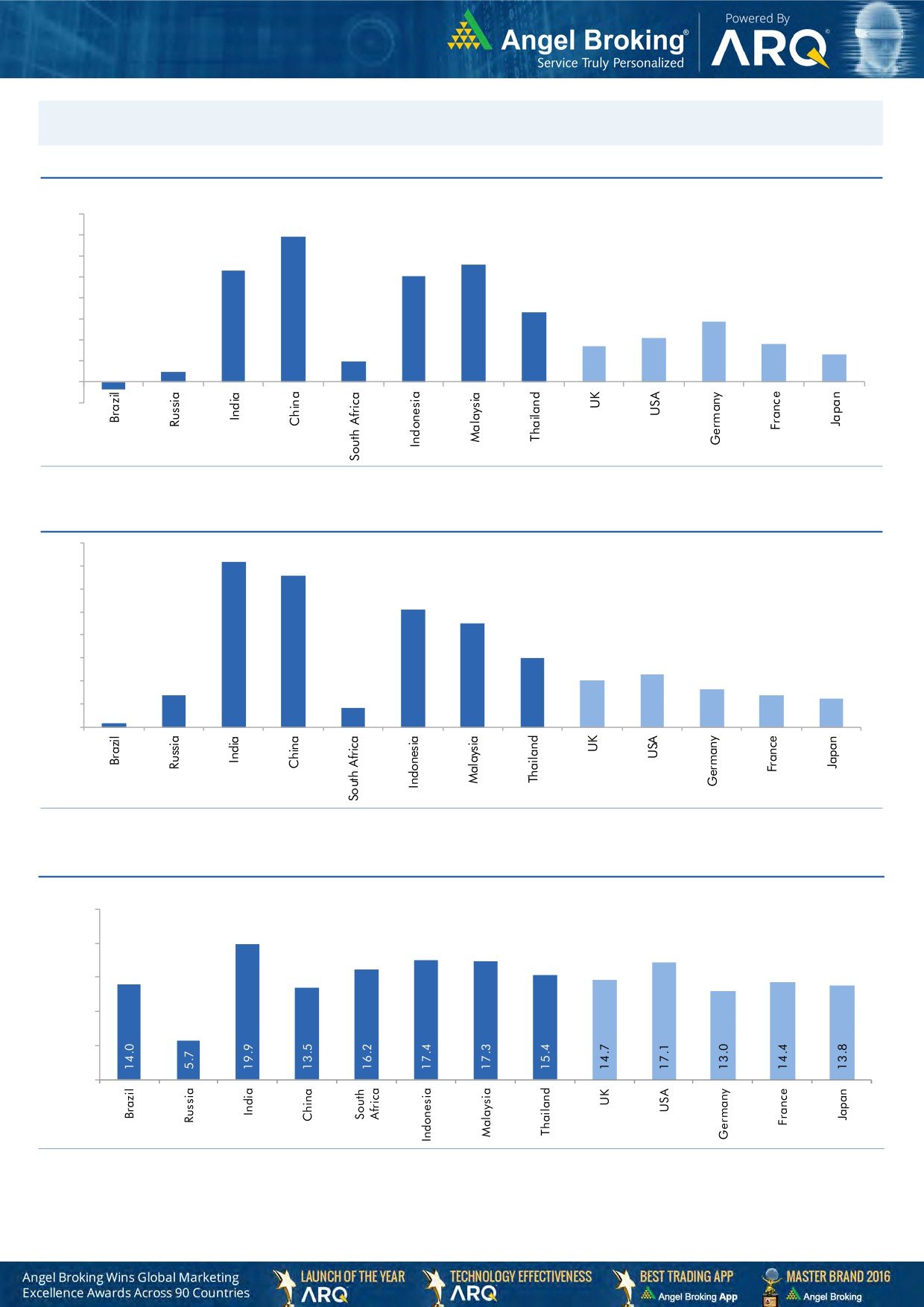

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.6

6.0

5.3

5.0

1.0

5.0

4.0

3.3

2.9

3.0

2.1

0.5

1.7

1.8

2.0

1.3

1.0

-

(1.0)

(0.4)

Source: Bloomberg, Angel Research

Exhibit 2: 2016 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

7.2

6.6

7.0

6.0

5.1

5.0

4.5

4.0

3.0

3.0

2.3

2.0

1.4

1.6

2.0

1.4

1.2

0.2

0.8

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

25.0

20.0

15.0

10.0

5.0

-

Source: IMF, Angel Research

Market Outlook

August 30, 2017

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

71,330

8.8

11.4

23.0

Russia

Micex

1,989

2.2

2.4

0.1

India

Nifty

9,796

(0.5)

4.2

14.9

China

Shanghai Composite

3,365

3.4

7.9

8.2

South Africa

Top 40

49,883

3.1

5.3

7.1

Mexico

Mexbol

51,314

0.0

4.0

7.7

Indonesia

LQ45

983

0.8

4.1

6.3

Malaysia

KLCI

1,761

(0.3)

(0.6)

4.1

Thailand

SET 50

1,035

0.5

1.8

2.9

USA

Dow Jones

21,865

0.1

3.5

17.9

UK

FTSE

7,337

(1.4)

(2.5)

8.2

Japan

Nikkei

19,363

(3.6)

(1.6)

16.7

Germany

DAX

11,946

(0.7)

(4.0)

15.1

France

CAC

5,032

(2.1)

(4.3)

11.9

Source: Bloomberg, Angel Research